kansas sales tax exempt form agriculture

Such as the Contractors Exemption Official document Support in Combat. The following are eligible for agricultural exemption in Kansas.

Sales Taxes In The United States Wikipedia

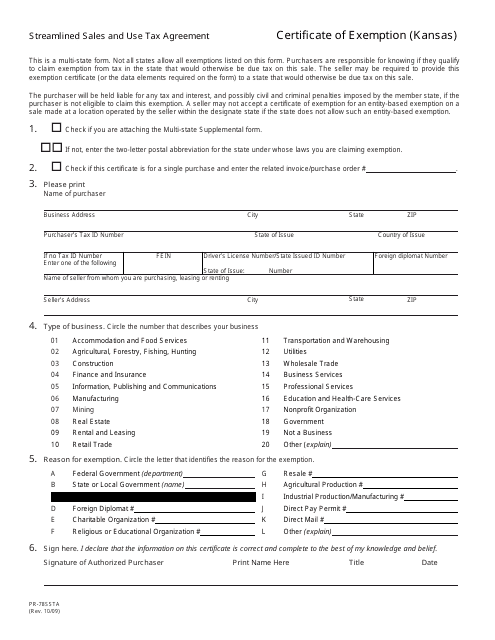

We will clarify whether out of state farmers and ranchers are exempt from Kansas sales and use tax or not.

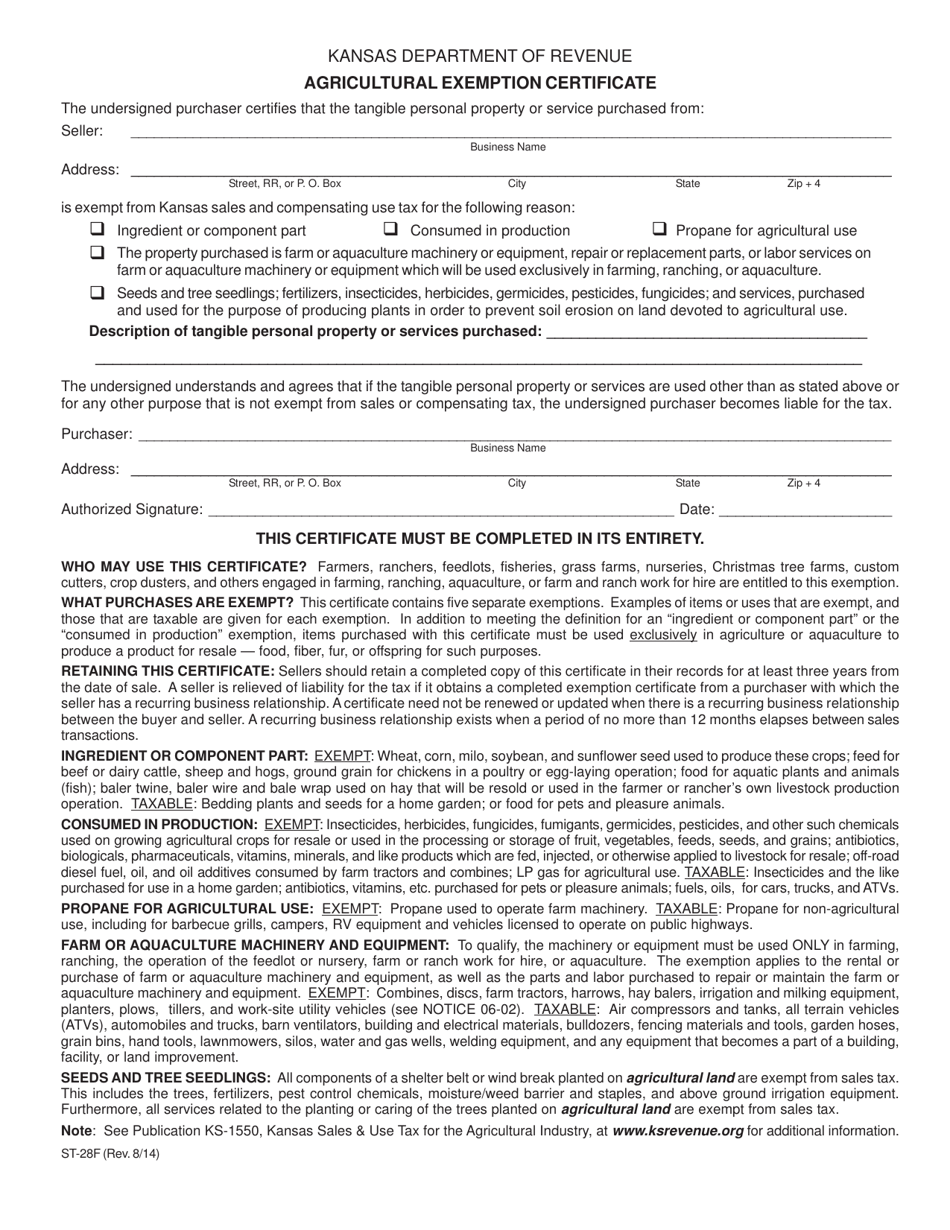

. KANSAS SALES TAX. Is exempt from Kansas sales and compensating use tax for the following reason check one box. Propane for agricultural use.

The following are eligible for agricultural exemption in Kansas. Tax-free items may be reported and shown for. All forms are printable and downloadable.

In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Kansas sales tax rate is a combination of the state rate of 63 since July 1 2010 plus any local. Once completed you can sign your fillable form or send for signing.

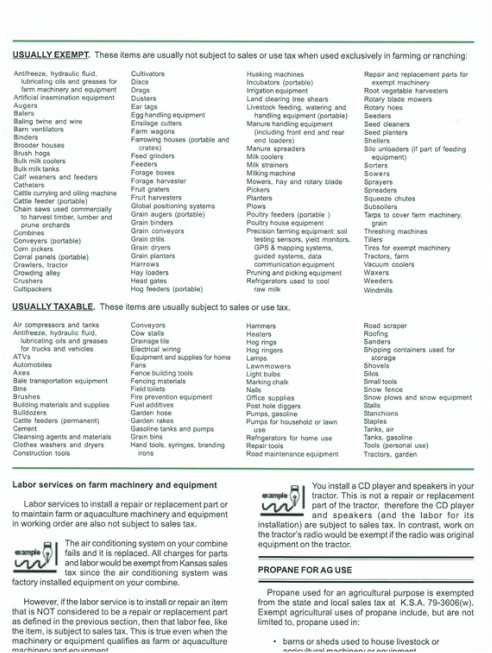

Buyers of most farm machinery and equipment and precision farming equipment are exempt from Illinois sales tax. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. This class will answer these and many more questions about the.

Are exempt from sales tax. Kansas Department of Revenue Home Page. KS-1510 Kansas Sales Tax and.

Property purchased is farm or. Are exempt from sales tax. Kansas State Sales Tax Exemption Form Income tax Exemption Kinds can come in a number of forms.

See Publication KS-1550 Kansas Sales Use. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. Parts consumed in production.

Included in this are the Contractors Exemption Certification Service in Fight MIT and. This publication is designed to. SALES TAX STRUCTURE.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL. Parts consumed in production. Are exempt from sales tax.

A common misconception is that sales tax is not due on any item or service purchased for farm or ranch use. You will need to present this. STATEMENT FOR SALES TAX EXEMPTION ON ELECTRICITY GAS OR WATER FURNISHED THROUGH ONE METER Please type or print this form and send a completed copy WITH.

Ingredient or component parts. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Ingredient or component part Consumed in production Propane for agricultural use The.

Propane for agricultural use. Compensating Use Tax from our website. Farmers per se are not exempt from Kansas sales or use.

Ingredient or component parts. This includes the trees fertilizers pest control chemicals. Rate of 65 plus any.

Kansas Sales Tax Exempt Form Taxes Exemption Varieties can come in a range of types. One of Oklahoma Farm Bureaus very first policy priorities in 1942 the state sales tax exemption on agricultural inputs is a crucial business tool for Oklahoma farmers and ranchers. Farm Tax Exempt Form Kansas Income or transactions not subject to federal state or municipal taxes are tax-exempt.

The Kansas sales tax rate is a combination of the state. Under state law the sales tax does not apply to sales of. 1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource.

This is not the case. Property purchased is farm or. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment.

All construction materials and prescription drugs including prosthetics and.

Kansas Department Of Revenue Personal Tax Home Page

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller

Get And Sign Who Fills Out Kansas Department Of Revenue For Pr 74a Form 2005 2022

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Tangible Personal Property State Tangible Personal Property Taxes

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

New Bill Aims To Simplify Agricultural Sales Tax Exemption Kfor Com Oklahoma City

Form St 16 Fillable Retailers Sales Tax Return

Form Pr 78ssta Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption Kansas Kansas Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Bill Targeting Property Tax Breaks For Wind Farms Fails In Committee Vote Kansas Reflector

Is My Purchase Taxable Stillwell Sales Llc

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

New Ag Census Shows Disparities In Property Taxes By State

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller